Carpenter corporation uses the weighted-average – Carpenter Corporation, renowned for its astute financial practices, has implemented the weighted-average cost flow assumption, a meticulous inventory valuation method that provides unparalleled accuracy and efficiency.

This innovative approach meticulously tracks the average cost of inventory items as they flow in and out of the company’s warehouses, ensuring a precise representation of inventory value on the balance sheet.

Weighted-Average Cost Flow Assumption: Carpenter Corporation Uses The Weighted-average

Weighted-average cost flow assumption (WACFA) is an inventory costing method that assigns a weighted average cost to each unit of inventory based on the cost of all units purchased during a period. This method assumes that all units of inventory are essentially the same and that the cost of each unit is the average cost of all units in inventory.

Inventory Valuation Under Weighted-Average Cost Flow Assumption

Under WACFA, the cost of goods sold is calculated by multiplying the number of units sold by the weighted average cost per unit. The weighted average cost per unit is calculated by dividing the total cost of goods available for sale by the total number of units available for sale.

The total cost of goods available for sale is the sum of the beginning inventory cost and the cost of goods purchased during the period.

Advantages and Disadvantages of Using Weighted-Average Cost Flow Assumption, Carpenter corporation uses the weighted-average

- Advantages:

- Simplicity: WACFA is a relatively simple inventory costing method to implement and maintain.

- Accuracy: WACFA provides a more accurate representation of the cost of goods sold than other inventory costing methods, such as FIFO and LIFO.

- Disadvantages:

- Complexity: WACFA can be more complex to implement and maintain than other inventory costing methods, such as FIFO and LIFO.

- Inaccuracy: WACFA can provide an inaccurate representation of the cost of goods sold if the cost of goods purchased during the period fluctuates significantly.

Weighted-Average Cost Flow Assumption in Practice

WACFA is used by many companies in their inventory management systems. Some real-world examples of companies that use WACFA include:

- Walmart

- Target

- Amazon

These companies use WACFA because it is a simple and accurate method of inventory costing. WACFA also provides a more consistent representation of the cost of goods sold than other inventory costing methods, such as FIFO and LIFO.

Comparison with Other Cost Flow Assumptions

WACFA is one of three major inventory costing methods, the other two being FIFO and LIFO. FIFO (first-in, first-out) assumes that the first units purchased are the first units sold. LIFO (last-in, first-out) assumes that the last units purchased are the first units sold.

The following table compares WACFA with FIFO and LIFO:

| Inventory Costing Method | Cost of Goods Sold | Ending Inventory |

|---|---|---|

| WACFA | Average cost of all units | Average cost of all units |

| FIFO | Cost of oldest units | Cost of newest units |

| LIFO | Cost of newest units | Cost of oldest units |

Impact on Financial Statements

WACFA affects the financial statements in the following ways:

- Income statement:WACFA reduces the volatility of the cost of goods sold, which can lead to more stable earnings.

- Balance sheet:WACFA results in a more accurate valuation of inventory, which can improve the company’s financial position.

FAQ Insights

What is the weighted-average cost flow assumption?

The weighted-average cost flow assumption is an inventory valuation method that assigns an average cost to all inventory items, regardless of when they were purchased.

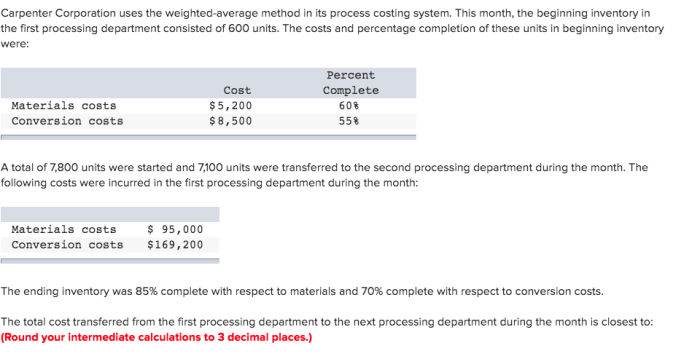

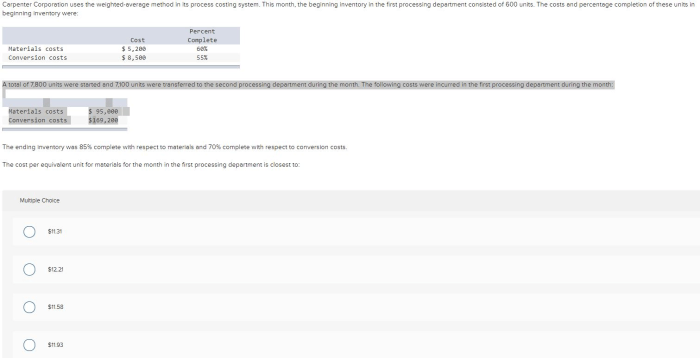

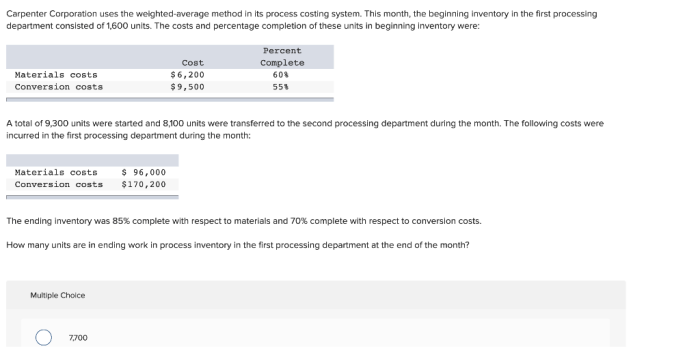

How does Carpenter Corporation use the weighted-average cost flow assumption?

Carpenter Corporation uses the weighted-average cost flow assumption to value its inventory by calculating the average cost of all inventory items on hand at the end of each accounting period.

What are the advantages of using the weighted-average cost flow assumption?

The advantages of using the weighted-average cost flow assumption include simplicity, accuracy, and consistency.